The landscape of digital payments in India is undergoing a monumental transformation, with RuPay credit cards spearheading this financial revolution. In the domain of RuPay credit cards enabled for UPI transactions, one name stands out prominently—Kiwi. Now take in deep about the world of RuPay credit cards, UPI payments, and why Kiwi is the best choice for the modern Indian consumer.

If you find yourself willing to shift to a digital financial ecosystem, this will assist you in making a safer, smarter decision.

RuPay Credit Cards: Pioneering Digital Payments in India

RuPay credit cards have become synonymous with secure, efficient digital transactions in India. As the country embraces a cashless economy, these cards have gained immense popularity due to their integration with the Unified Payments Interface (UPI).

This powerful combination of traditional credit cards with the convenience of UPI has paved the way for a new era in financial transactions.

Some key facts about RuPay credit cards

- Launched in 2012 by the National Payments Corporation of India (NPCI),

- Operates on a domestic network, providing an alternative to Visa and Mastercard.

- Over 500 million RuPay cards were issued as of March 2019.

- Processes around 1.5 billion transactions every month.

- Enables transactions via cards, UPI apps, and mobile wallets.

- Integrated across all major banks, financial institutions, and digital payment platforms in India

With RuPay cards, India has built its domestic card payment network, ensuring the transactions stay within the country. This has helped RuPay emerge as a truly Indian payment solution.

Kiwi: Trailblazing the Future of Digital Payments

In the dynamic landscape of digital payments in India, Kiwi stands out as a pioneer, offering a Virtual RuPay Credit Card designed to cater to the evolving needs of Indian consumers.

This innovative fintech solution not only provides instant access to a digital credit card but also ensures seamless integration with UPI, enabling users to make quick payments across merchants and services.

Key highlights of Kiwi

- India’s first credit card on UPI

- Instant issuance of a virtual RuPay credit card

- Seamless payments across merchants via UPI

- Exclusive rewards program with cashback on transactions

- Zero annual and joining fees

- In-app card management features

With its focus on convenience, transparency, and security, Kiwi aims to transform the credit card experience for Indian users.

Exclusive Benefits of Kiwi RuPay Credit Cards,

One compelling reason to choose Kiwi is the array of exclusive benefits it offers to existing RuPay cardholders. On joining Kiwi, users get a guaranteed 100 INR signup bonus along with 0.25% cashback on every transaction.

Linking your RuPay card to the Kiwi app unlocks a suite of rewards, making each payment not just seamless but also gratifying.

Some of the notable benefits include

- Sign-up bonus

- Upto 1% cashback on payments via scan and pay

- Exclusive offers from top brands and merchants

- Personalized deals and cashback based on spending patterns

By incentivizing transactions, Kiwi succeeds in transforming the concept of credit card rewards in India.

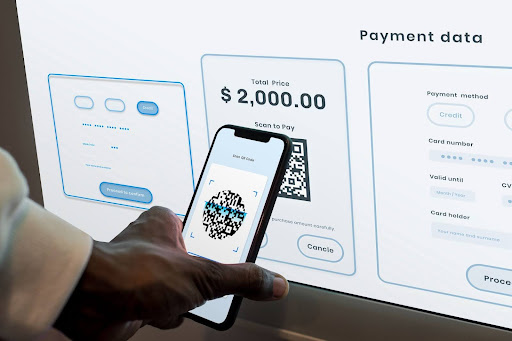

Seamless UPI Payments with Kiwi

One of Kiwi’s marquee features is its commitment to facilitating seamless UPI payments. The Virtual RuPay Credit Card allows users to effortlessly pay bills and make UPI transactions directly from the Kiwi app.

This level of convenience, paired with the speed and efficiency of UPI, gives Kiwi an edge in the competitive digital payments space.

Some key UPI features offered by Kiwi

- Pay bills directly via the Kiwi app.

- Scan any UPI QR and make payments through the credit card.

- Send or request money from contacts

- Track all UPI transactions in one place.

- Quickly check your account balance before making payments.

- Receive instant transaction alerts and notifications.

- Built-in security features like MPIN

By integrating UPI, Kiwi has elevated the credit card experience to keep pace with India’s booming digital payment ecosystem.

Instant Virtual Credit Card Access

Kiwi accelerates innovation in financial services with its instant virtual credit card issuance feature. The process allows eligible users to get access to a virtual credit card instantly, eliminating the hassle of paperwork or waiting periods.

This enables customers to activate and start using the credit card immediately through the Kiwi app.

Some interesting stats on the process

- 99% virtual credit card approval rate

- Less than 1 minute of card issuance time

- On-demand access with no physical card delivery is required.

- A custom credit limit is assigned based on eligibility.

- Activate and use the card instantly for online and offline payments.

The speed and on-demand availability of the cards make Kiwi the preferred choice for accessing credit among tech-savvy Indians.

360-degree Credit Card Management

Kiwi recognizes the significance of robust credit card management tools. The app serves as an all-in-one hub for managing the card, including:

- Checking credit limit, available balance, and reward points

- Viewing detailed statements and transaction history

- Blocking or reporting a lost card with a single click

- Setting transaction alerts and limits

- Contactless support is available via in-app chat or email.

- Making payments instantly or scheduling them for a future date

- Downloading statements, invoices, and applying for a physical card

By centralizing all critical card features, Kiwi empowers customers with control and transparency over their spending.

Efficient UPI payments and complete transparency

Kiwi has elevated UPI-based credit card payments by focusing on efficiency, transparency, and robust security.

The app is optimized for fast checkouts and money transfers, with each transaction taking just a few seconds.

Moreover, Kiwi upholds complete transparency by

- Eliminating hidden fees

- Communicating all terms and conditions upfront

- Providing a detailed breakdown of all costs, taxes, and charges

- Sending instant notifications on transactions, spending, and bills

- Answering customer queries promptly 24×7

This emphasis on transparency is a welcome change from traditional financial institutions, making Kiwi a trustworthy fintech brand.

The Complete Package: Kiwi’s Spectrum of Features

Unlike most payment apps, Kiwi positions itself as an all-encompassing financial ecosystem that offers a suite of exclusive services built around a user-centric philosophy. It brings credit to UPI, elevating the UPI experience in India.

With an interest-free period, cashback rewards, instant credit access, and simplified money management, Kiwi unlocks new dimensions of convenience.

Kiwi’s spectrum of features covers the entire credit card lifecycle

Card Application

- The paperless process is completed fully online.

- Eligibility checks and instant decision-making

- Onboarding was completed in minutes.

Card Usage

- Contactless payments via UPI across merchants

- Interest-free period up to 50 days

- 1% cashback on scan-and-pay transactions

- Zero liability in cases of fraudulent transactions

Card Management

- In-app control over credit limits and statements

- Block cards and report disputes instantly.

- Friendly, 24×7 customer support

Payments

- Seamless UPI payments from linked bank accounts

- Pay bills directly and set reminders.

- Review payment history and track expenses.

Offers and Rewards

- Exclusive deals from top brands

- Personalized offers based on spending patterns

- Get cashback on every purchase.

By bringing this full spectrum of features under one platform, Kiwi has set a new standard for credit experiences in India.

An Unmatched Cashback and Rewards System

Kiwi’s cashback and rewards system is the gold standard amongst payment apps in India. Users earn guaranteed cashback on every purchase, whether it’s buying groceries or dining out.

Kiwi also curates personalized offers so users get deals on brands they love. This focus on rewarding customers at every step is unmatched among payment apps. Kiwi essentially pays users to spend smartly!

Next-Gen Credit Experience with Kiwi

Kiwi goes beyond being a payments app, it represents an upgraded credit experience tailored for modern users.

Salient features include:

- Instant access to a credit line with a virtual card

- Secure transactions backed by RuPay’s technology

- Lucrative rewards program on card spends

- A completely digital process for a frictionless user experience

By blending innovation with customer-centricity, Kiwi delivers a next-gen credit experience that resonates with the aspirations of young India.

Democratizing credit access with Kiwi

For a long time, access to credit cards remained concentrated among the affluent sections of society. Kiwi is changing the status quo by making credit cards accessible to millions of Indians.

Salient aspects of Kiwi’s approach include:

- A digital and paperless application process requiring minimal documents

- Detailed review and approval for most applications

- Completely online application process with no branch visit needed

By lowering the barriers faced by consumers, Kiwi has opened the doors for wider credit access across India.

Why Virtual Credit Cards Are the Future

Virtual credit cards have emerged as a game-changing innovation in the ever-evolving landscape of digital payments in India.

These digital avatars of physical credit cards come loaded with an array of advantages, transforming the way individuals make payments and manage finances.

Enhanced Security

- No physical card means a reduced risk of theft or loss.

- Ideal for online transactions with additional authentication requirements

- Limited validity ensures additional security.

Financial Control

- Pre-set spending limits and expiration dates on virtual cards.

- Use different virtual cards for different types of expenses.

- Avoid overspending thanks to built-in restrictions.

Instant Issuance and Availability

- On-demand access anytime, anywhere

- Quickly generate new virtual cards for immediate use.

- Suitable for fast-paced digital transactions

With evolving consumer needs and the growth of digital payments, virtual credit cards represent the future of payments.

Kiwi is at the forefront of this shift with its innovative virtual RuPay credit card.

Embrace the Kiwi Difference

In a market teeming with payment solutions, Kiwi rises above the noise. It exemplifies a progressive approach to credit, prioritizing convenience, personalization, and transparency. As consumers step into the digital financial ecosystem, Kiwi becomes the smarter choice that goes beyond transactions to become a trusted partner.

By blending innovation with simplicity, Kiwi delivers on its promise of making digital credit accessible to millions of Indians.